Our collective knowledge of the issues permits our attorneys to guide our clients through the most complex property-loss-causation-and-valuation issues and provide thorough opinions regarding an insured’s commercial property coverage. We also have the knowledge and experience to place a value on the loss of business-income claims that often accompany commercial property losses.

Assisting Insurers with Claims From the Most Catastrophic to the Routine

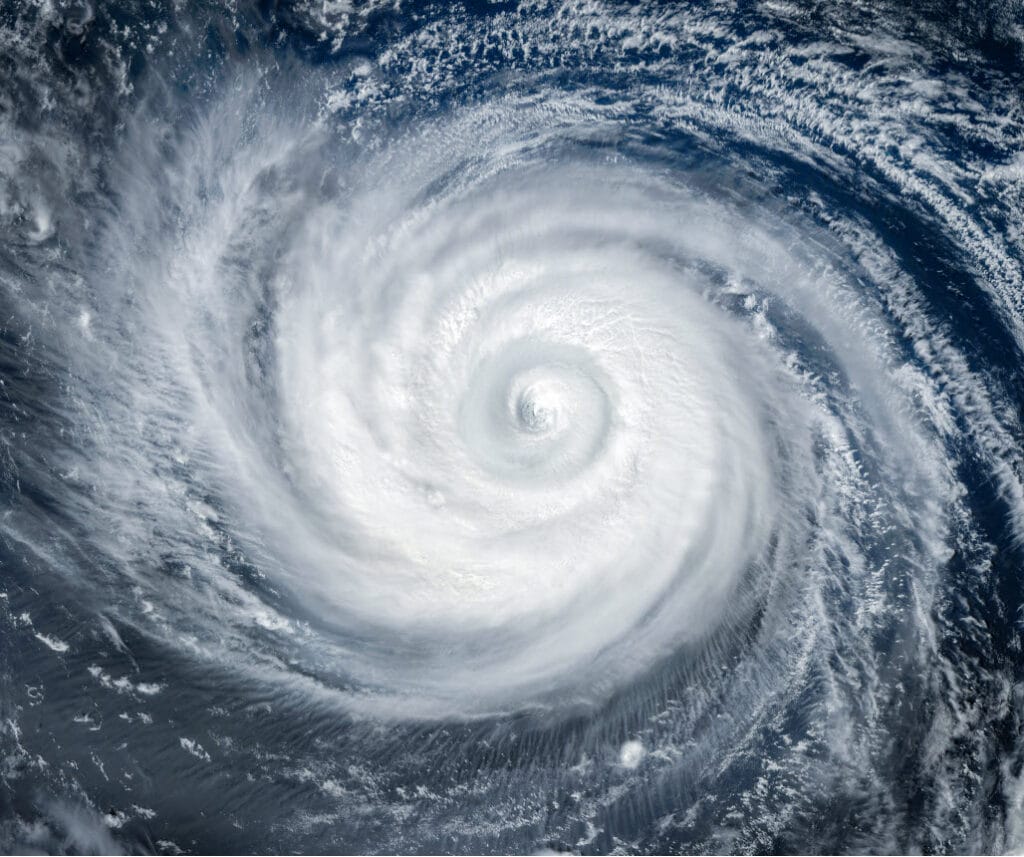

Our lawyers have worked on numerous storm-related residential property claims, including claims arising from Hurricanes Ida, Laura, Delta, Zeta, Ike, Isaac, Katrina, Rita, Superstorm Sandy, and other wind and hailstorms that have regularly plagued Louisiana and Texas. Lugenbuhl’s lawyers also handle non-catastrophic homeowners’ claims, such as claims for theft, non-storm water damage, and intentional and unintentional fire claims.

At Our Clients’ Side Throughout Every Issue

Our experience allows us to assist our clients with pre-litigation issues, such as fabricated claims, policyholder misconduct, examinations under oath, and appraisals. It also allows our seasoned litigators to navigate our clients through litigation of contractual and extra-contractual claims, such as bad faith and prompt-payment violations.

The Extensive Scope of Our Experience

With expertise in both Louisiana and Texas laws, our attorneys have successfully helped insurers evaluate and/or litigate the following issues, among others:

- Evaluation of personal property damage including investigation of proof of ownership and valuation

- Investigation and evaluation of commercial losses and business income claims

- The appraisal process, including petitions for a court-appointed umpire

- Fraudulent-claims investigations

- Pre-litigation investigation, including examinations under oath

- Fire-loss investigation

- Boiler and machinery coverage issues

- Vacancy issues

- Valued policy law issues

- Application of the water-damage exclusion

- Application of the wear-and-tear and faulty workmanship exclusions

- Overhead and profit issues

- Ordinance and law issues

- Bad faith claims

- Prompt-payment claims

- Duty-to-mitigate issues

- Duty-to-provide-prompt-notice-of-loss issues

- Weather-related damage claims

- Fraudulent and fabricated claims

- Investigation and valuation of losses

- Examinations under oath

- Application of exclusions

- Bad faith claims